If there’s one thing American consumers love, it’s Japanese cars.

According to World’s Top Exports count, nearly 20% of the money U.S. consumers spent on auto imports in 2024 went to Japanese car companies. The only country with a higher percentage was our next-door neighbor, Mexico.

Japanese automaker Toyota just reported its third-fiscal quarter results. On the surface, it appears the company counts the first three quarters of its fiscal year as a win.

Still, the results may have cost the company’s CEO his job.

U.S. 2025 new-vehicle sales forecast

- GM: 2.83 million vehicles (+5.1% year over year); 17.3% market share

- Toyota: 2.52 million vehicles (+8.4% YoY); 15.5% market share

- Ford: 2.18 million vehicles (+5.6% YoY); 13.4% market share

- Hyundai: 1.84 million vehicles (+7.9% YoY); 11.3% market share

- Honda: 1.42 million vehicles (+0.6% YoY); 8.8% market share

Source: Cox Automotive

The Japanese automaker says it was able to weather the impact of U.S. tariffs and ride strong demand to increased sales volumes. But it was forced to reduce sticker prices and increase marketing efforts to make that happen.

Toyota reported operating income of nearly $21 billion through the first three quarters of the year. It expects to end the fiscal year with an operating profit of more than $24 billion. But that’s $3 billion less than it reported through the first three quarters of a year ago, and its full-year projection is $6.4 billion below last year’s.

Toyota says tariffs will cost the company $9.23 billion in fiscal 2025.

But it could have been worse.

In August, the Japanese government reported that its overall exports fell for the fourth consecutive month, including a 14% decline in automotive exports to the U.S.

However, the U.S. and Japan struck a deal in late September that lowered Japan’s tariff rate to 15% from 25%. If that had not happened, Toyota’s tariff bill could have been 10% higher.

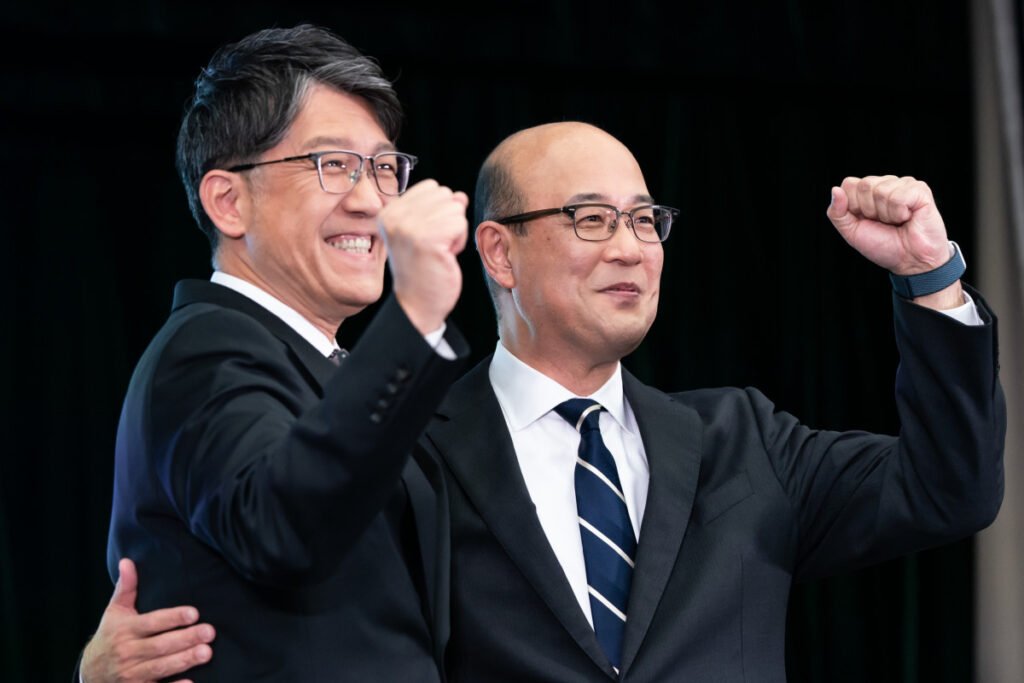

Toyota demotes CEO, names CFO to replace him

On Friday, February 6, Toyota announced that current CEO Koji Sato will step down on April 1, just three years after taking the job, to be replaced by current CFO Kenta Kon.

Sato will transition to the newly created role of chief industry officer and will also become vice chairman after the demotion. Kon is a close ally of Toyota Chairman Akio Toyoda, according to Reuters, and he is known for keeping costs low.

Related: Toyota’s $26 billion deal could be hurt by latest activist move

Top auto importers to U.S. in 2024

- Mexico: 22.8%

- Japan: 18.6%

- South Korea: 17.3%

- Canada: 12.9%

- Germany: 11.7%

Kon served as Toyoda’s secretary from 2009, the year he became CEO, until 2017, when he was appointed head of the accounting division.

Toyota says Kon will focus on internal company management, while Sato will handle broader industry issues. Sato replaced Toyoda in April 2023 amid criticism that the company was slow to adopt EV technology while its rivals spent billions on electric vehicles.

Three years later, GM is reporting a $7 billion write-down, Ford says it is writing down $19.5 billion, and Stellantis says it is writing down $26 billion, all because of their EV investments.

And now Toyoda’s apprentice is back at the helm. However, Kon said during a press conference, according to Reuters, that he was shocked to be approached about the job, and Sato said that Toyoda was not involved in the company’s decision.

Toyota is on strong footing as sales increase

Toyota expects to sell 9.75 million units this fiscal year, a 4.1% increase over last year.

Combined with Lexus, its luxury arm, Toyota expects to sell 10.5 million vehicles globally, a 2.2% year-over-year increase.

Related: Toyota plans major US investment following strong output, sales

Despite the large tariff bill, Toyota says it was able to cut costs elsewhere. However, its U.S. operating income still fell 5.6% year over year.

While some investors may be shaken up by a company like Toyota changing CEOs, shares were rising more than 2% at last check Friday afternoon, Feb. 6, thanks to the company’s strong third-quarter performance.

Toyota reported third-quarter revenue of about $86 billion with earnings per share of $6.15. Analysts were expecting revenue of $82.9 billion and earnings of $4.53 per share.

Still, beneath the surface, a 37% decline in EBITDA to $10.9 billion from $17.2 billion, and falling margins to 8.9% from 9.8% last year, are concerning. But the company did sell 8.2 million vehicles in nine months after selling 8.2 million globally during the same period a year ago.

U.S. remains Toyota’s most important region

Toyota sold more than 2.3 million vehicles in the U.S. in 2024, a 3.7% year-over-year increase.

Of the 9.75 million vehicles the company expects to sell globally this year, 2.96 million will come from North America, and the rest will come from Japan, Europe, Asia, and elsewhere.

However, despite strong sales in the region in the previous quarter, North America was the only one of Toyota’s six operating regions to incur a loss.

So Toyota has a plan to keep more of the money it makes from U.S. sales.

As part of the company’s $10 billion U.S. manufacturing commitment over the next five years, Toyota has announced plans to invest $912 million to build hybrid capacity across five manufacturing plants.

The move is part of Toyota’s plan to increase production of the hybrid-electric Corolla.

“Customers are embracing Toyota’s hybrid vehicles, and our U.S. manufacturing teams are gearing up to meet that growing demand,” said Kevin Voelkel, senior vice president, manufacturing operations.

“Toyota’s philosophy is to build where we sell, and by adding more American jobs and investing across our U.S. footprint, we continue to stay true to that philosophy.”

Related: Toyota makes a major bet on US manufacturing