Key Takeaways:

- Diversification is key: Spread your investments across different assets to reduce risk and ensure steady income.

- Research thoroughly: Understand your options, from dividend stocks to real estate, to find the best fit for your financial goals.

- Consistency pays off: Regularly contribute to your income-generating investments to build a larger passive income stream over time.

- Automate your savings: Use automated transfers to put money into your investments without having to think about it.

- Educate yourself continuously: Stay informed about market trends and new investment opportunities to optimize your income strategy.

Understanding Passive Income

Before venturing into the specifics of building a passive income stream, it’s important to establish a solid understanding of what passive income truly entails. In essence, passive income refers to earnings that require minimal effort or active involvement on your part. This contrasts sharply with traditional forms of income, where you must actively trade your time for money. Instead, passive income allows you to make your money work for you, whether through investments, rental properties, or other revenue-generating activities. The beauty of this income style is that it can continue to grow and provide financial stability even when you’re not actively working, paving the way for greater financial security.

What is Passive Income?

While many people associate income with a 9-to-5 job, passive income opens the door to a variety of revenue-generating opportunities that do not rely solely on your direct involvement. Common sources of passive income include earning royalties from your creative works, generating income through dividend-paying stocks, or obtaining rental income from properties you own. Essentially, passive income is designed to provide you with a steady stream of earnings, allowing for the potential of financial independence. Each of these sources requires varying degrees of initial investment—whether that be time, money, or both—but the ultimate goal is to establish a consistent flow of income without necessitating your constant attention.

While constructing a passive income stream may require considerable upfront work and investment, its long-term benefits often make it worthwhile. The effort you put in now can lead to significant financial rewards in the future, and many find that the initial investment soon pays off, leading to a more relaxed lifestyle. This not only grants you the flexibility to spend your time as you wish but can also bolster your financial resilience in uncertain times, as you won’t be solely reliant on a single income source.

Key Benefits of Passive Income Streams

The key benefits of passive income streams are numerous and can significantly enhance your financial well-being. Firstly, passive income promotes financial freedom, allowing you to establish a consistent flow of revenue that is not tied to the hours you work. This means that you can enjoy more leisure time, pursue hobbies, or even travel without worrying about bills piling up. Additionally, passive income can help diversify your earnings, creating a buffer against economic instability. By not relying solely on your job, you’ll have added financial security, which is increasingly important in today’s unpredictable economy.

Income diversification is one of the most impactful advantages of passive income. By engaging in various income-generating activities, you not only maximize your earning potential but also enhance your financial security in the face of unforeseen circumstances. The creation of passive streams allows you to break free from the traditional constraints of working for a paycheck, which can be a game changer in your financial journey. You will find that each passive income source can contribute significantly to your overall wealth, leading to greater peace of mind and an opportunity for growth beyond what a conventional job may offer. Embracing this financial strategy can ultimately be a positive and transformative experience in your life.

Factors to Consider When Building Passive Income

Some key factors to think about when building a steady passive income stream include your personal goals, risk tolerance, and the specific methods you choose to employ. It’s important to create a strategy that matches your lifestyle and your long-term aspirations. Here are several factors that should guide your decisions:

- Investment timeframe: the duration you plan to keep your money tied up

- Level of involvement: how hands-on do you want to be with your investments?

- Potential returns: what kind of income do you expect?

- Market conditions: understanding the broader economic landscape

- Tax implications: how will your income be taxed?

Each of these elements plays a significant role in determining the best course for your passive income venture. It’s vital to conduct thorough research to ensure that your chosen methods align with your financial objectives and lifestyle preferences. Engaging with other investors and professionals can provide invaluable insight as you navigate this landscape and work towards building a secure future. For a deeper exploration of strategies in real estate, you may find this resource about How To Build A Stable Passive Income Stream With Real Estate enlightening.

Time Commitment

Clearly, the amount of time you are willing to dedicate to managing your passive income investments is a significant factor in your success. Many passive income channels, such as real estate or dividend stocks, might require initial effort in research and setup but will require less involvement over time. However, some methods may involve ongoing maintenance and attention to keep the income flowing. Understanding your available time and how you prefer to allocate it will help you choose the right passive income strategies for your circumstances.

It’s important to consider whether you prefer a strategy that allows for complete automation or if you don’t mind providing regular input. For instance, if you’re tackling rental properties, you may need to deal with tenant management and property maintenance, which can add to your time commitment. On the other hand, investing in index funds or ETFs often requires less monitoring and is more hands-off. Balancing your personal responsibilities with your investment strategies can set you on the right path towards achieving your financial security.

Ultimately, efficiency will be your best friend when it comes to ensuring the successful generation of passive income. Focus on establishing systems that require minimal ongoing attention once set up, turning your time investment into a more manageable endeavor. By aligning your passive income efforts with your available time and overall life goals, you will create a more enjoyable and sustainable financial journey.

Financial Investment

Factors impacting your financial commitment are important when establishing a successful passive income stream. The amount of money you invest will significantly influence the return you receive. Each investment opportunity comes with its own financial demands. For instance, real estate investments typically require a substantial initial outlay, while dividend stocks may allow you to start with a smaller amount. Additionally, you’ll want to evaluate whether you are prepared for the associated costs such as management fees, taxes, and maintenance expenses.

The amount you commit can dictate not only the potential income but also the level of risk involved. Allocating too little might limit your returns, while substantial investment can pose risks if not managed wisely. Thus, it’s important for you to evaluate your overall financial situation and make informed decisions that align with your comfort zone. Diversifying your investments will be key; spreading your capital across various avenues can help mitigate risks while maximizing your income potential.

The more informed and strategic you are regarding your financial investment, the greater control you will have over your passive income journey. Assess your financial landscape and design a plan that allows you to navigate this rewarding space efficiently and effectively, minimizing the likelihood of unforeseen challenges. This informed approach will empower you to build a sustainable passive income strategy and work toward your financial goals.

How to Identify Suitable Passive Income Streams

Unlike many misconceptions that passive income is solely about receiving money without effort, identifying suitable streams for that source requires a thoughtful and strategic approach. The first step in this process is to evaluate your current resources, both financial and time-oriented, as these will influence the type of income streams you can pursue. You should consider the levels of risk you’re willing to take, as different passive income avenues can vary widely in stability and return on investment. Additionally, it’s important to assess the level of involvement you want in managing these income streams, as some options may demand more attention than others, impacting your overall financial strategy.

Your goal here is to align your passive income pursuits with your financial objectives and lifestyle preferences. An effective way to do this is by brainstorming options and creating a structured list of potential avenues for passive income that piques your interest. You can think broadly about options such as rental properties, dividend-paying stocks, peer-to-peer lending platforms, or even digital products like eBooks and online courses. The better you understand your personal and financial situation, the more informed your decisions will be when choosing the right passive income streams for you.

Lastly, conduct thorough research on the options you’re interested in by looking into their profitability, potential risks, initial investment requirements, and long-term sustainability. This research will empower you to make educated decisions and potentially avoid income streams that may not perform as expected. By taking the time to carefully analyze your choices, you can build a strong foundation that supports your ultimate goal of financial security through reliable and suitable passive income channels.

Market Research Techniques

Techniques for effective market research are fundamental for identifying suitable passive income streams. Start by gathering comprehensive data about potential markets through online resources, market surveys, and industry reports. Utilize platforms such as Google Trends, social media analytics, and relevant online forums to gauge interest levels and consumer behavior related to your selected passive income ideas. These market insights will help you understand the competitive landscape and identify gaps in the market where your options may thrive.

Additionally, consider engaging with communities or networks that focus on passive income topics. You can gain firsthand insights from those who have successfully implemented similar income streams or have experience in the same area. Networking can provide valuable feedback and may also lead to collaborations or mentorship opportunities that can accelerate your passive income endeavors. Community involvement not only expands your knowledge base but also helps you stay updated on the latest trends and potential market shifts.

Finally, don’t shy away from testing the waters. Conduct A/B testing for online products, evaluate varying pricing strategies for services, or even start small with investments in stocks or real estate to gauge performance. By continuously refining your approach based on market research and real-world feedback, you position yourself for long-term success in generating a steady and reliable passive income stream.

Evaluating Your Skills and Interests

Assuming you have a list of potential passive income streams in mind, the next logical step is to evaluate your skills and interests to determine which options best align with your capabilities. This reflective process requires you to take stock of your current skill set, professional background, and personal passions. Whether you excel in writing, digital marketing, teaching, or have a knack for managing finances, your existing abilities can significantly contribute to the success of your passive income ventures.

In addition, take time to ponder what activities genuinely excite you and hold your interest over the long term. Building a passive income stream demands commitment and motivation, especially during the initial setup phases, so choosing something you are passionate about will likely yield better results. Consider creating a Venn diagram to visually represent the intersection of your skills, interests, and the potential income streams you’ve identified. This can provide clarity on where to focus your efforts.

Identify additional skills through this process that you might wish to learn or enhance, which could open up new avenues for generating passive income. For example, if you’re drawn to real estate but have limited knowledge, you might enroll in a short course to bolster your expertise in the field. By strategically matching your skills and interests with suitable passive income streams, you greatly increase your chances of success, minimize risks, and create a fulfilling journey towards achieving financial security.

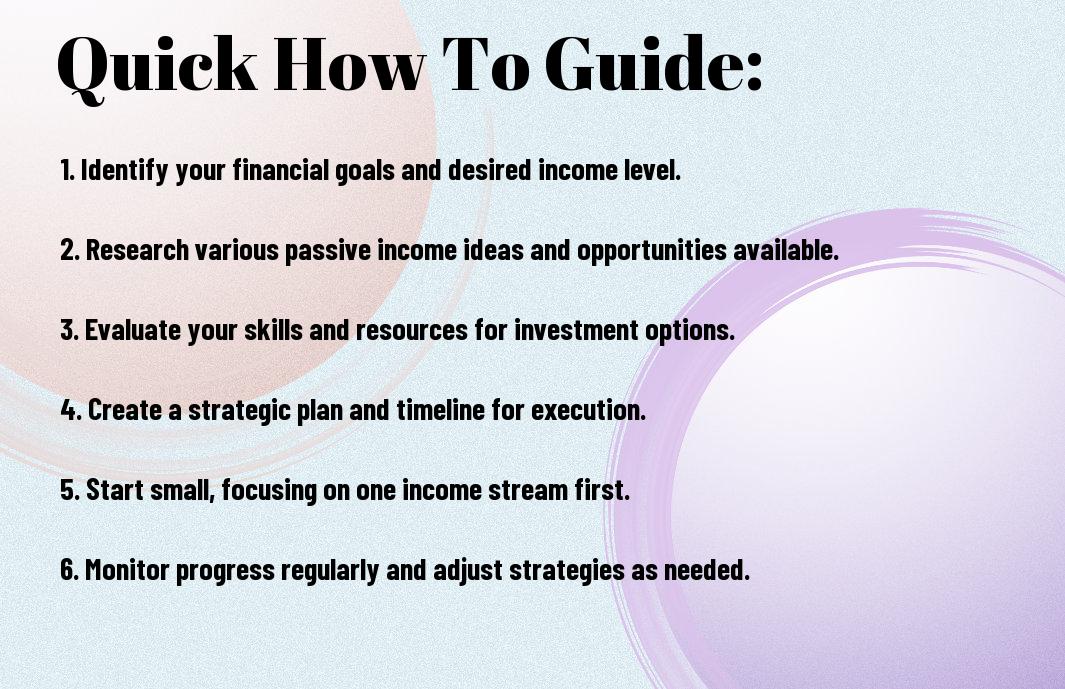

Tips for Setting Up Your Passive Income Stream

After establishing a goal for your financial security, the next step is to create a solid foundation for your passive income stream. It’s crucial to approach this process with a meticulous mindset, as the decisions you make will significantly influence your success. To aid you in navigating this journey, consider the following tips:

- Conduct thorough research on various passive income avenues

- Choose a sustainable business model that aligns with your interests and skills

- Invest time in understanding the legal and financial implications of your chosen model

- Test your ideas in a smaller capacity before scaling up your investments

- Stay resilient and adjust your strategies based on real-world performance

After you have grounded your strategy with these crucial tips, you can examine deeper into the specifics of your chosen path. Setting a strong foundation for your passive income stream requires a comprehensive understanding and commitment to the business model that suits your lifestyle and financial goals.

Choosing the Right Business Model

Setting up the perfect passive income stream begins by identifying a business model that resonates with your personal interests and abilities. Whether you are drawn to real estate investing, affiliate marketing, or creating a digital product, knowing where your passions lie can make the arduous journey more enjoyable. It is advisable to assess your existing knowledge and expertise; this way, you can leverage your skills to enhance your chances of success. This preliminary evaluation ensures that you are not only sticking to market trends but are also engaging with something that excites you.

In selecting the right model, consider the long-term sustainability and potential for growth. Passive income opportunities vary significantly, with some involving minimal effort once established, while others may require ongoing involvement. When exploring your options, prioritize those that align with your values and goals and have a clear, actionable plan for scalability. For instance, investing in dividend stocks may provide steady returns with less hands-on management than starting a brick-and-mortar business.

Moreover, understanding your target audience is fundamental when choosing a business model. Identifying who will benefit from your product or service allows you to tailor your approach more precisely, increasing engagement and retaining customers. This strategic targeting is not just crucial to immediate success but also to robust and sustainable growth over time. After you have made informed decisions about your business model, you will be better poised to start generating a consistent passive income stream.

Leveraging Technology and Automation

On your journey towards establishing a passive income stream, leveraging technology and automation can significantly enhance your efficiency and profitability. Embracing digital tools and platforms allows you to streamline your processes, ultimately saving you time and effort. For instance, using website builders and content management systems can enable you to launch and manage blogs or online stores with minimal technical skills. In addition, by utilizing social media marketing and email automation tools, you can effectively engage with your audience without the need for constant manual intervention.

Furthermore, automating your financial tracking and reporting through tools like spreadsheets and expenses management applications can provide you with valuable insights into your revenue sources. This data allows you to optimize your strategies, adjust your pricing, and refine your offerings, ensuring you’re always on top of your game. By incorporating technology and automation into your operations, you can concentrate on scaling your business rather than getting caught up in mundane tasks.

Another benefit of leveraging technology is your ability to analyze market trends and consumer behavior in real-time, leading to informed decision-making. By utilizing analytics and reporting tools, you gain visibility into performance metrics and identify areas for improvement. This proactive approach helps mitigate risks associated with passive income ventures while optimizing your chances for success. The combination of automation and technology not only enhances operational effectiveness, but it also paves the way to a more fulfilling entrepreneurial experience. After internalizing this strategy and implementation process, you can expect to see tangible results in your passive income journey.

Strategies for Maintaining and Growing Your Income Stream

Once again, it is imperative to focus on the initiatives that can help you maintain and grow your passive income stream. Building a steady income is one thing, but ensuring its longevity and potential for expansion is vital for your overall financial stability. This requires a proactive approach, a willingness to adapt to changing market conditions, and a commitment to continuous improvement. By adopting effective strategies, you can create a reliable foundation that is not only resilient to economic fluctuations but also capable of generating higher returns over time.

One of the most critical aspects of maintaining your income stream is to develop a clear plan for regular assessments of your investments and income sources. This means taking the time to analyze performance metrics, evaluate market trends, and identify areas for improvement. By routinely assessing your income streams, you can determine what’s working well and what may need adjustments. You can also identify opportunities to reinvest profits into higher-yield options, thereby maximizing your overall potential for growth.

Moreover, nurturing relationships with other industry professionals can provide insights and opportunities that you might not uncover on your own. Join relevant forums, attend networking events, and leverage social media to connect with others in your field. These connections can offer valuable advice, collaboration opportunities, and even the chance to expand your income streams. Note, with the right strategies in place, and by constantly keeping your finger on the pulse of your investments, you can achieve a steady and growing passive income.

Regular Assessment and Optimization

If you want to ensure the longevity and performance of your passive income stream, implementing regular assessments and optimization strategies is key. Schedule time each month or quarter to review your investments and their returns. Look for patterns and trends in your income data, and don’t hesitate to adjust your approach if the returns are not meeting your expectations. By continually analyzing where your money is going and how effectively it is working for you, you can reign in any underperforming assets and reallocate your resources to more promising opportunities.

Moreover, focus on productivity. For instance, if you have a rental property, keeping an eye on local market trends could help you adjust rent prices effectively or identify if it makes sense to sell. In the digital realm, successful content creators often review their engagement metrics and traffic sources to pinpoint what types of content resonate best with their audience. These insights can guide you in modifying your strategies to optimize your income-generating efforts.

In addition, reinvesting a portion of your income back into your income streams can provide a significant boost. This may include improving your existing assets, purchasing new tools, or expanding your portfolio. With consistent assessment, not only do you keep your income stream vibrant, but you also position yourself favorably for future opportunities and advancements.

Diversifying Income Sources

Sources of passive income can become stale if you rely solely on one or two channels. Diversifying your income sources not only fortifies your financial foundation but also reduces the risk associated with potential downturns in a single investment. For example, if you earn money through rental properties, consider also creating a side hustle like an online course or a blog that generates ad revenue. This layered approach can provide many benefits. In the event that one source underperforms, your financial security won’t be jeopardized.

Having multiple streams allows you to tap into various market opportunities. For instance, if you invest in stocks, it’s wise to allocate some funds into real estate or peer-to-peer lending platforms. These alternative income streams can provide not just different risk levels but also distinct ways to benefit from market movements. You can also explore avenues such as dividend stocks, royalties from your creative works, or affiliate marketing. By embracing this diversity, you can increase your chances of attaining steady income regardless of market variations.

With an eye toward the future, consider your personal strengths and interests when exploring additional sources of income. By aligning your pursuits with your passions or expertise, you are more likely to remain engaged and committed. Whether it’s developing an online store, investing in a franchise, or creating a niche blog, the potential for generating income diversifies significantly. As you embrace a multifaceted approach, not only do you secure your financial future, but you also open the door to new possibilities for growth and prosperity.

Common Pitfalls to Avoid

Your journey toward building a steady passive income stream can be filled with challenges. However, being aware of common pitfalls can save you time, money, and frustration. One major danger is mismanagement of your time and resources. Many individuals become enthusiastic about passive income opportunities and dive headfirst into multiple projects without adequately assessing their capacity to manage them. This eagerness can lead to overcommitment, which in turn may dilute your effectiveness across various initiatives. To avoid this, focus on a few carefully selected opportunities that align with your strengths and interests, allowing you to maximize your efforts and yield better results. For inspiration, check out the 25 Best Passive Income Ideas To Make Money in 2025 to help you identify what might work best for you.

Mismanagement of Time and Resources

Resources play a significant role when it comes to generating passive income. You need to evaluate how much time and capital you can realistically invest in your selected ventures. Going into a project without a clear plan can lead to overspending or wasted hours on tasks that do not provide a return on your investment. Establishing a well-defined budget and timeline before committing to any passive income venture can mitigate these issues. Additionally, consider the potential for leveraging existing skills or tools to streamline your processes. This strategic approach allows you to devote your resources more efficiently and can lead to greater profitability.

Moreover, you should also be mindful about diversifying your passive income sources to spread out risk. Relying heavily on a single stream can be precarious, especially if that source suddenly diminishes. By investing in varied passive income opportunities, such as dividend-paying stocks, real estate rentals, or online businesses, you can create a balanced portfolio that serves as a buffer against unexpected downturns in any one area. Just be sure that each chosen venture still aligns with your strengths and strategic goals; this targeted approach will enhance your time and resource management considerably.

Overlooking Legal and Tax Implications

Any passive income project you undertake does not exist in a vacuum. Each venture comes with its own set of legal and tax obligations that must be considered. Failing to pay attention to these can result in significant complications, including unforeseen fines or even legal action. You may find yourself overwhelmed by local regulations, tax codes, and licensing requirements if you’re unprepared. Therefore, it’s crucial to educate yourself about the legal frameworks governing your chosen income streams, allowing you to operate within the law. Consulting with professionals such as accountants or legal advisors can guide you through the complexities that you may encounter.

Legal matters are more than just formalities; they can have a profound impact on your passive income strategy. Not understanding tax implications might lead you to underreport your earnings, resulting in higher tax liabilities down the road. Analyzing how your passive income will be taxed, whether through capital gains, rental income, or dividends, is key to effective financial planning. Your tax responsibilities may vary significantly based on whether you’re treating your income as a hobby or a legitimate business. Seeking reputable resources or professionals who specialize in taxation and legalities can safeguard you from potential pitfalls that threaten your financial security.

Summing Up

Now that you have explored the crucial guide on how to build a steady passive income stream for financial security, it is time to reflect on the steps you can take to transform your financial future. By understanding the various methods available for generating passive income—such as real estate investments, dividend stocks, and creating digital products—you can identify the best strategies that align with your skills and financial goals. The key is to choose avenues that resonate with you, allowing you to leverage your strengths while simultaneously diversifying your income sources. Continuous education in these areas will empower you to make informed decisions, ensuring that you stay adaptable in an ever-evolving financial landscape.

As you commence on this journey, it is crucial to approach each opportunity with diligence and a long-term perspective. Building a steady passive income stream is not an overnight achievement; it requires patience, perseverance, and a commitment to learning. You will likely encounter challenges along the way, but each obstacle can also serve as a valuable lesson that enhances your ability to make strategic choices in the future. By taking calculated risks and staying informed about market trends, you position yourself for greater financial stability, making it easier to attain your long-term financial objectives.

Ultimately, establishing a reliable passive income stream can significantly enhance your financial security, granting you increased autonomy over your wealth and time. You can enjoy peace of mind as you cultivate multiple income sources, reducing your reliance on a single job or salary. As you integrate these strategies into your overall financial plan, you not only enhance your present circumstances but also pave the way for a prosperous and secure future. So take action now, invest in your education, and commit to building your passive income portfolio—your future self will thank you.

FAQ

Q: What is passive income and why is it important for financial security?

A: Passive income refers to earnings that require minimal effort to maintain, allowing individuals to generate revenue without actively working for it. Establishing a steady passive income stream is important for financial security as it provides financial stability, diversifies income sources, and helps individuals achieve their financial goals, such as saving for retirement or funding personal projects. By having additional income that does not rely on a traditional job, one can better weather economic downturns and unexpected expenses.

Q: What are some common methods to generate passive income?

A: There are several popular methods to create passive income, including investing in dividend-paying stocks, real estate rental properties, peer-to-peer lending, creating and selling online courses, and writing books or blogs. Each of these methods has its own level of risk, required initial investment, and potential return, so it’s imperative to conduct thorough research and consider your own financial situation before diving in.

Q: How can I start building a passive income stream from scratch?

A: To begin building a passive income stream, first assess your current financial position, skills, and resources. Next, identify potential passive income opportunities that align with your interests and risk tolerance. Start small by investing in low-cost index funds or exploring rental properties if you have the capital. Additionally, consider creating digital products or membership sites that can generate income over time. It’s important to reinvest profits into growing your passive income sources for greater returns in the long run.

Q: What is the role of diversification in building passive income?

A: Diversification is imperative in building passive income streams as it helps to spread risk across multiple income sources. Relying on a single passive income stream can be risky, as any fluctuations or downturns in that area can lead to significant financial strain. By diversifying your passive income sources—such as combining real estate investments with dividend stocks and digital products—you can create a more stable and resilient income portfolio that can withstand market changes.

Q: How long does it typically take to see returns from passive income investments?

A: The timeline for seeing returns on passive income investments can vary widely depending on the investment type and strategy. For example, dividends from stocks may be received quarterly, while rental income from real estate typically generates monthly cash flow. However, some investments, like building an online course or writing a book, may take time to develop before you can start earning income. Generally, it requires patience, consistent effort, and occasionally ongoing maintenance before one can realize substantial returns from passive income investments.

Discover more from Secrets to Make Money Online

Subscribe to get the latest posts sent to your email.