Key points:

Bitcoin traders reveal the key BTC price points for a bullish recovery.

The risk of a “double top” for price remains, with $102,000 on the radar should support fail.

The Bitcoin bull market does not have much time left — if history is a guide.

Bitcoin (BTC) neared $113,000 after Wednesday’s Wall Street open as buyers sought to cement a market bounce.

BTC price outlook hinges on $112,000

Data from Cointelegraph Markets Pro and TradingView showed local highs of $112,646 on Bitstamp.

Now up over $3,000 from multiweek lows seen the day prior, BTC/USD continued to split opinions over where it might head next.

“$BTC has reclaimed its EMA-100 level,” popular trader BitBull wrote in a post on X, referring to the 100-day exponential moving average at $110,850.

“This has been very crucial for bottom formation, and for now bulls are still in control. If BTC holds this level, I wouldn’t be surprised to see a rally towards $116K-$117K level.”

While maintaining a bearish bias, fellow trader Roman, who this week called time on the Bitcoin bull market entirely, emphasized the importance of the $112,000 mark.

“Looks like a breakdown & bearish retest for now. If 112k support is truly lost, 102k support should be next. Also looks like a double top is confirming here,” he told X followers on the day.

“I expect lower over the next few days – unless we completely regain 112k support.”

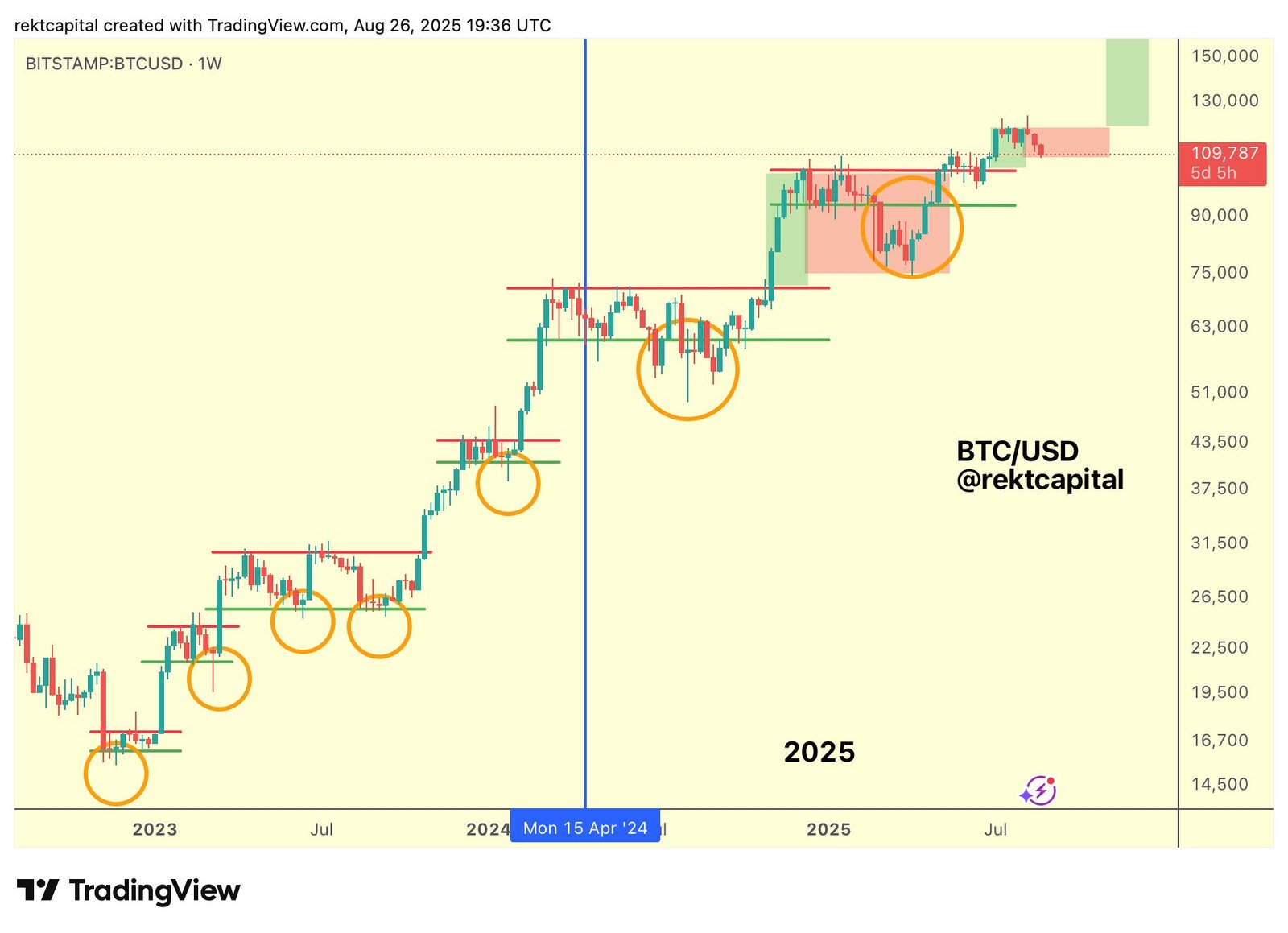

Popular trader and analyst Rekt Capital, meanwhile, reiterated similarities between the current BTC price pullback and previous bull markets.

“History doesn’t always repeat but it often rhymes,” he summarized, confirming that price had entered its second “price discovery correction.”

“Bitcoin ended up rallying into new All Time Highs by Week 6 before transitioning into Price Discovery Correction 2. History suggests this pullback will likely be shallower & shorter than past ones.”

Is time running out for the bull market?

Debate also centered around the longevity of the bull market, with market participants similarly torn over how long it might last.

Related: Bitcoin can still hit $160K by Christmas with ‘average’ Q4 comeback

For Rekt Capital, history demands that October form the deadline for a bearish trend change.

The previous bull market lasted 152 weeks

That’s ~1064 days

Almost 3 years

We are already 144 weeks into this Bull Market$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 27, 2025

This contrasts hopes that the next Bitcoin bear market is still years off — a view put forward by David Bailey, the dedicated Bitcoin adviser to US President Donald Trump.

“There’s not going to be another Bitcoin bear market for several years,” Bailey argued on X at the weekend, pointing to institutionalization of BTC as an asset.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.