Fidelity announced the launch of a stablecoin on the Ethereum mainnet, positioning the token as a compliance-wrapped settlement dollar distributed through the firm’s brokerage, custody, and wealth management channels.

The move lands amid what looks like a stablecoin sprawl, as estimates suggest 59 new major stablecoins launched in 2025 alone, per third-party tracker Stablewatch.

This looks like overcrowding, but it’s segmentation. Stablecoins that all say “$1” aren’t interchangeable once distribution, compliance perimeter, redemption rails, permitted users, chain portability, and treasury strategy are priced in.

Fidelity’s FIDD digital dollar

Fidelity’s token, the Fidelity Digital Dollar (FIDD), is issued by Fidelity Digital Assets, National Association, a national trust bank. Reserves consist of cash, cash equivalents, and short-term US Treasuries managed by Fidelity Management & Research.

The token is transferable to any Ethereum mainnet address, though Fidelity’s documentation explicitly reserves the right to restrict or freeze certain addresses.

Primary distribution runs through Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers, plus exchanges. Fidelity commits to publishing daily supply and reserve net asset value disclosures at the end of the business day.

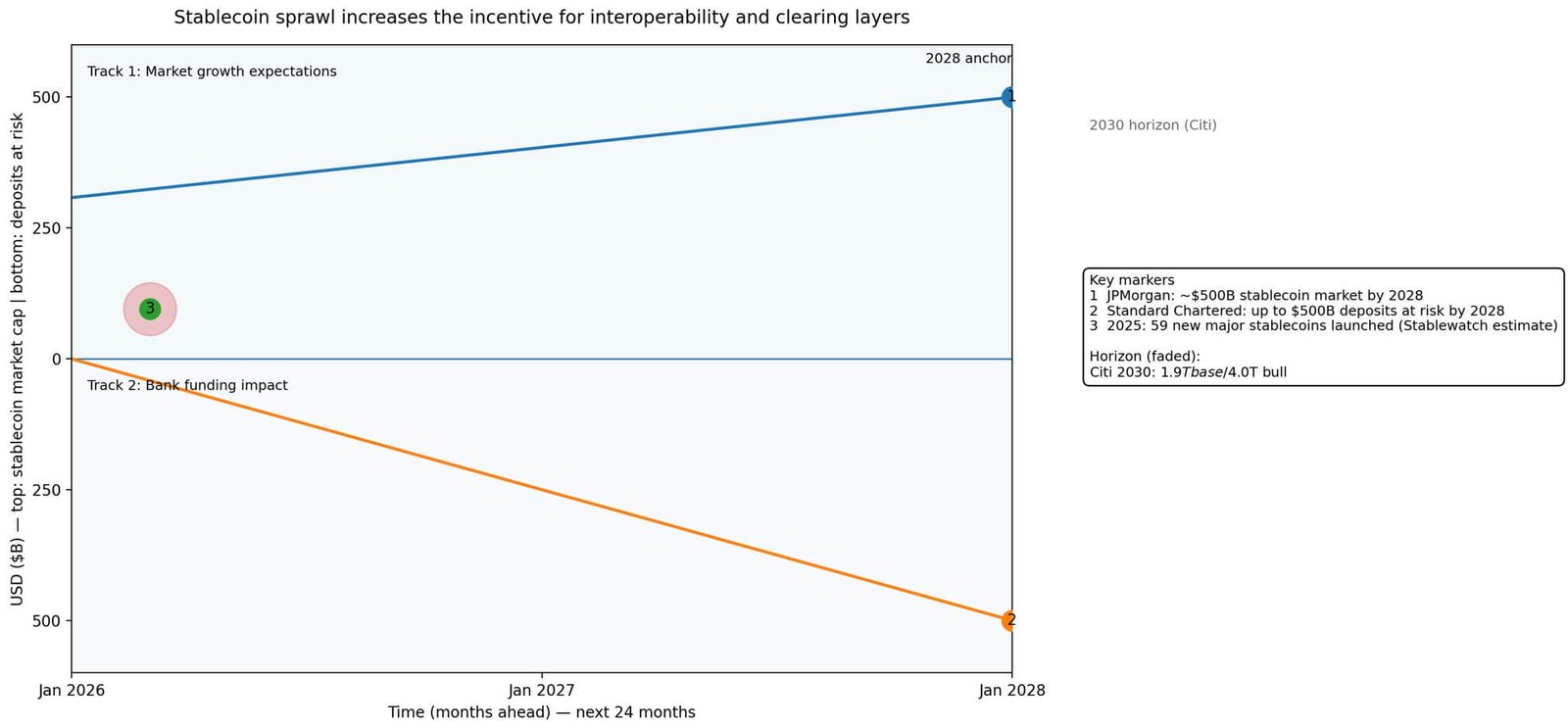

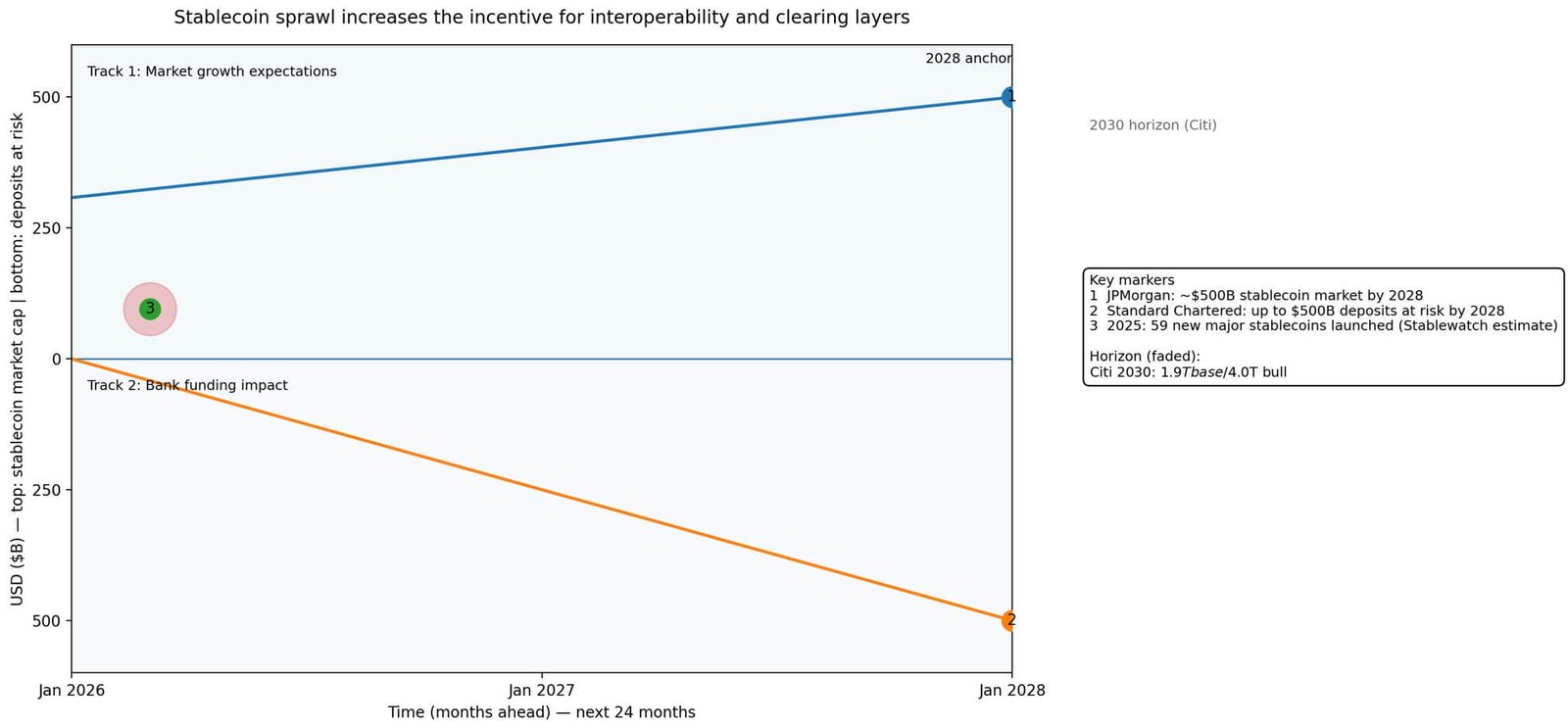

The numbers support the urgency. Stablecoins are now a $308 billion market, while on-chain settlement activity has reached scale: Visa and Allium cite $47 trillion in total stablecoin transaction volume over the past year, with $10.4 trillion after removing outliers.

Visa’s own stablecoin settlement volumes sit at an annualized run rate of $4.5 billion, versus the company’s $14.2 trillion in annual payments.

Standard Chartered warns US banks could lose up to $500 billion in deposits to stablecoins by 2028. JPMorgan previously pushed back on trillion-dollar projections and pegged the stablecoin market at around $500 billion by 2028, noting only about 6% of demand was payments at the time.

The regulatory lane just opened

Two regulatory developments explain the timing.

The first is the GENIUS Act becoming law in July 2025, establishing a federal framework for payment stablecoins and explicitly contemplating interoperability standards.

The Office of the Comptroller of the Currency conditionally approved multiple national trust bank charters and conversions in December 2025, including those for Fidelity Digital Assets, Circle’s First National Digital Currency Bank, Ripple, BitGo, and Paxos.

This approval window pulled issuance inside clearer supervisory perimeters and turned compliance oversight into a competitive feature.

Fidelity’s token reads like a Fidelity-distributed settlement dollar with an explicit US compliance perimeter and a built-in policy surface that makes it operationally different from offshore “everyone-can-hold-it” dollars.

The firm’s national trust bank status gives it direct regulatory supervision, and its distribution through Fidelity platforms gives it instant access to its brokerage customers, advisors, and institutional custody clients.

Redemption happens within Fidelity’s operational hours and banking relationships, not through offshore correspondent networks.

The token lives on Ethereum mainnet, a choice that prioritizes composability with decentralized finance protocols and cross-platform settlement over permissioned private chains.

Five wedges that create different dollars

The segmentation thesis depends on recognizing five structural differences that make stablecoins non-fungible in practice, even when they all claim dollar parity.

Distribution moat determines who can onboard at scale, such as brokerage customers, card networks, marketplaces, and how. Fidelity’s token is natively distributed through Fidelity rails plus exchanges.

Tether’s US-focused token, USAT, is issued via Anchorage Digital Bank and designed for US compliance, a separate product from USDT targeting a different regulatory lane.

Klarna’s stablecoin trial represents commerce-native distribution, a differentiator from brokerages or exchanges. European bank stablecoin moves show the same segmentation dynamic outside the US, driven by regional compliance and distribution.

The compliance perimeter defines permitted users and policy controls, including trust bank oversight, KYC and AML requirements, blocklisting and freezing powers, and disclosure cadence.

Fidelity’s documentation explicitly contemplates restricting and freezing addresses. This creates a token that can operate on open infrastructure while maintaining regulatory compliance hooks that satisfy bank supervisors.

The trade-off: composability with constraints.

Redemption rails and settlement hours separate “internet hours” transfers on-chain from fiat redemption constraints. Who has bank access and how quickly redemptions clear determines whether a stablecoin functions as instant settlement or deferred settlement.

Visa has pointed out that stablecoins can be used behind the scenes even when merchants don’t “accept stablecoins.” In this case, the stablecoin becomes the settlement layer, and the merchant sees dollars.

Chain portability shapes where liquidity pools and where composability work. Other tokens start more walled-garden and expand later, or launch multi-chain from day one. Fidelity’s choice reflects a bet on where liquidity and interoperability standards will consolidate.

Treasury strategy covers reserve composition and who captures yield, issuer versus customer, and constraints on paying interest directly. Fidelity’s reserves include short-term US Treasuries, managed in-house.

Other issuers make different bets on reserve yield, pass-through economics, and transparency commitments.

Stablecoins are becoming compliance-wrapped distribution products, not just digital cash.

The “59 new stablecoins” figure, while likely undercounted and definition-sensitive, signals that new entrants believe distribution plus regulatory perimeter will differentiate their dollar from incumbents.

The market is testing whether brand, compliance moat, and native distribution channels can carve out territory in a space dominated by Tether and Circle.

| Token / issuer | Distribution moat | Compliance perimeter | Redemption rails / settlement hours | Chain portability | Treasury strategy + disclosures |

|---|---|---|---|---|---|

| FIDD (Fidelity / national trust bank) | Native distribution via Fidelity Digital Assets / Fidelity Crypto / Wealth Manager channels + exchanges | Trust-bank perimeter; reserves right to restrict/freeze addresses; KYC/AML via Fidelity onboarding | Redemptions primarily through Fidelity’s banking relationships and ops window (even if token moves 24/7 on-chain) | Ethereum mainnet, transferable to any ETH address (subject to restrictions) | Cash, cash equivalents, short-term USTs; daily supply + reserve NAV disclosures |

| USDC (Circle) | Broad exchange + fintech + payments integrations; widely used in DeFi and CeFi | Regulated posture; compliance controls (blacklisting/attestations); widely accepted by institutions | Redemptions via Circle and partners; “internet-hours” transfer but fiat redemption depends on banking rails | Multi-chain (broad portability/liquidity) | Reserve mix of cash + short-dated government assets; regular reserve attestations / disclosures |

| USDT vs USAT (Tether / offshore lane vs U.S.-focused lane) | USDT: global exchange/OTC dominance; USAT: positioned for U.S.-compatible distribution partners | USDT: broader global usage; USAT: explicitly U.S.-compliance-oriented perimeter (separate product, tighter eligibility/policy surface) | USDT: redemptions via Tether processes; USAT: likely more U.S.-bank-aligned rails depending on distribution partners | USDT: multi-chain ubiquity; USAT: initially narrower footprint as it builds compliant rails | USDT: reserve disclosures/attestations vary by period; USAT: designed to meet stricter expectations for U.S. lane transparency/controls |

| Commerce-native stablecoin trial (Klarna) | Checkout/merchant network distribution wedge (embedded at point of sale) | Compliance defined by commerce relationships + geographies (merchant KYC, consumer rules) | Redemption tied to commerce settlement cycles; can offer “instant” merchant-facing settlement even if backend conversion happens | Often starts walled-garden, then expands to chains/partners as liquidity and compliance mature | Reserves + disclosures shaped by program design; may optimize for payment ops over DeFi composability |

| EU bank stablecoin move (regional bank issuer) | Distribution via bank customer base, corporate treasury clients, and regional payment rails | EU regulatory perimeter (regional licensing, reporting, KYC/AML), often stricter on permitted users | Redemption and settlement integrated with local banking hours/rails, plus potential instant schemes where available | May start on permissioned or select public chains; portability often constrained by policy | Reserve management tends to align with bank treasury constraints; disclosures governed by local regulation and supervisor expectations |

Fragmentation pressure creates interoperability demand

The forward-looking question isn’t “too many stablecoins” but who builds the interoperability and clearing layers that reconcile them.

Citi explicitly flags trust, interoperability, and regulatory clarity as key shapers of product-market fit for new money forms. The firm revised its 2030 issuance forecasts to $1.9 trillion base case and $4 trillion bull case, citing 2025 growth and announcements.

Standard Chartered’s $500 billion deposit shift by 2028 represents a banking disruption scenario in which stablecoins compete directly with bank funding. JPMorgan’s skepticism of only 6% payments demand provides the reality check.

Three scenario bands define the next 12 to 24 months.

A base case sees segmented growth plus partial interoperability: more brand dollars launch, but clearing layers make them functionally exchangeable for many flows.

A bear case sees fragmentation plus slow merchant penetration: stablecoins remain largely trading, and DeFi collateral with a limited payment share, aligning with JPMorgan’s earlier skepticism.

A bull case sees internet-hours settlement become normal: deposit displacement accelerates, and Standard Chartered’s $500 billion deposit shift becomes a headline signal that stablecoins are competing directly with bank funding.

The GENIUS Act and OCC trust bank approvals have standardized the lane.

Fidelity’s token demonstrates what that lane looks like in practice: a dollar that travels at internet speed, operates within a US compliance perimeter, and is distributed through Fidelity’s existing customer base.

The token isn’t trying to replace Tether or Circle. It’s trying to become the settlement layer for Fidelity’s own financial services stack and, potentially, a neutral rail for cross-institutional clearing where both parties prefer a trust-bank-issued dollar.

The market will decide whether distribution and compliance moats justify dozens of segmented dollars or whether consolidation pressure pushes the industry toward a few dominant tokens plus interoperability standards.

Fidelity bets that its customers want a dollar they can trust, that regulators can supervise, and that Fidelity controls.

If that thesis holds, the winners over the next two years aren’t just stablecoin issuers. They’re the infrastructure players who build the clearing, attestation, and interoperability layers that let different dollars settle against each other without requiring everyone to hold the same one.