Key points:

Bitcoin attempts to liquidate longs at the Wall Street open with $115,000 a focus.

Markets are flipping short ahead of Wednesday’s Federal Reserve meeting.

Gold hits fresh all-time highs above $3,700 before correcting.

Bitcoin (BTC) wobbled at Tuesday’s Wall Street open as analysis eyed potential liquidations.

Bitcoin leverage spikes with longs at risk

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD becoming unsettled as the US trading session began.

Price gyrated between $114,800 and $115,300 while surrounded by blocks of liquidity on exchange order books, both up and down.

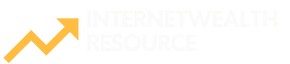

“There’s a huge cluster of long liquidations below the current price, specifically around the 114724.3 level. That’s a lot of trapped longs,” trading resource TheKingfisher observed in part of its latest commentary on X.

An accompanying chart showed relevant “pain” levels for traders above and below spot price.

“This chart doesn’t predict the future, but it tells you where the pain is. And where the pain is, price movements often follow,” TheKingfisher added, noting high levels of leverage active on the market.

The day prior, popular trader Skew identified similar low-timeframe volatility, querying what he implied was manipulative price behavior.

$BTC

The psyops continue https://t.co/yJAKAijXLt pic.twitter.com/JY5tBX49RV— Skew Δ (@52kskew) September 15, 2025

“Market remains top side heavy with persistent supply & offloading into price,” he summarized in his latest market coverage.

Skew said traders were flipping short into the week’s key macroeconomic event: the US Federal Reserve’s interest-rate decision. The Federal Open Market Committee (FOMC) was expected to cut rates for the first time in 2025 by 0.25%.

“Quite large positioning decay already going into FOMC, not surprising although short positioning is starting to pick up as the consensus trade going into FOMC,” he concluded.

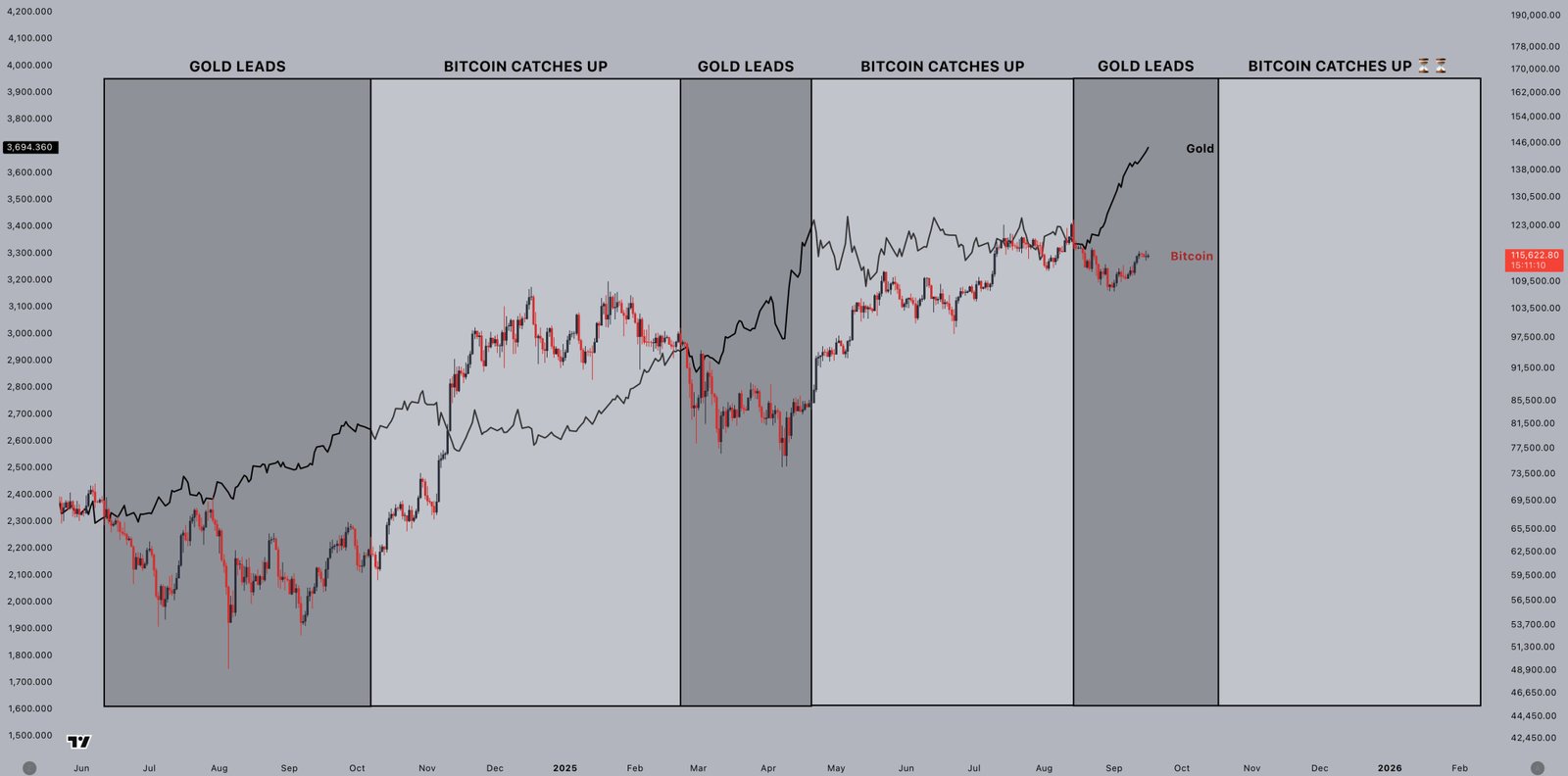

BTC price action yet to copy gold

Pre-FOMC nerves were apparent across risk assets.

Related: Bitcoin ‘sharks’ add 65K BTC in a week in key demand rebound

US stocks were modestly down at the open, while gold saw noticeable volatility and a fresh all-time high of $3,703.

⚡️JUST IN: Gold surges to a new ATH above $3,700. pic.twitter.com/tcM3T2Gmtt

— Cointelegraph (@Cointelegraph) September 16, 2025

As Cointelegraph reported, analysis argues that both Bitcoin and gold are “pricing in” future US economic conditions.

“Gold leads the way. Bitcoin follows,” popular trader Jelle agreed in part of an X reaction, referencing the tendency for BTC price action to follow gold’s with a several-month delay.

Gold remained firmly in the lead based on year-to-date performance, up 40% since the start of the year against Bitcoin’s 23%.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.