Key takeaways:

China’s central bank stimulus could redirect liquidity into cryptocurrencies.

Rising US Treasury yields suggest lower risk aversion, supporting potential recovery in altcoin markets.

Central banks stimulate growth by reducing interest rates or enabling special financing conditions, effectively increasing the money supply. This dynamic benefits risk assets such as stocks and cryptocurrencies.

Traders now question if the Chinese central bank’s next move will provide the liquidity boost that finally drives altcoins beyond their previous all-time highs.

Economic stimulus is beneficial for the cryptocurrency market

A March 2025 21Shares report highlighted a striking 94% correlation between Bitcoin’s (BTC) price and global liquidity, surpassing both the S&P 500 and gold.

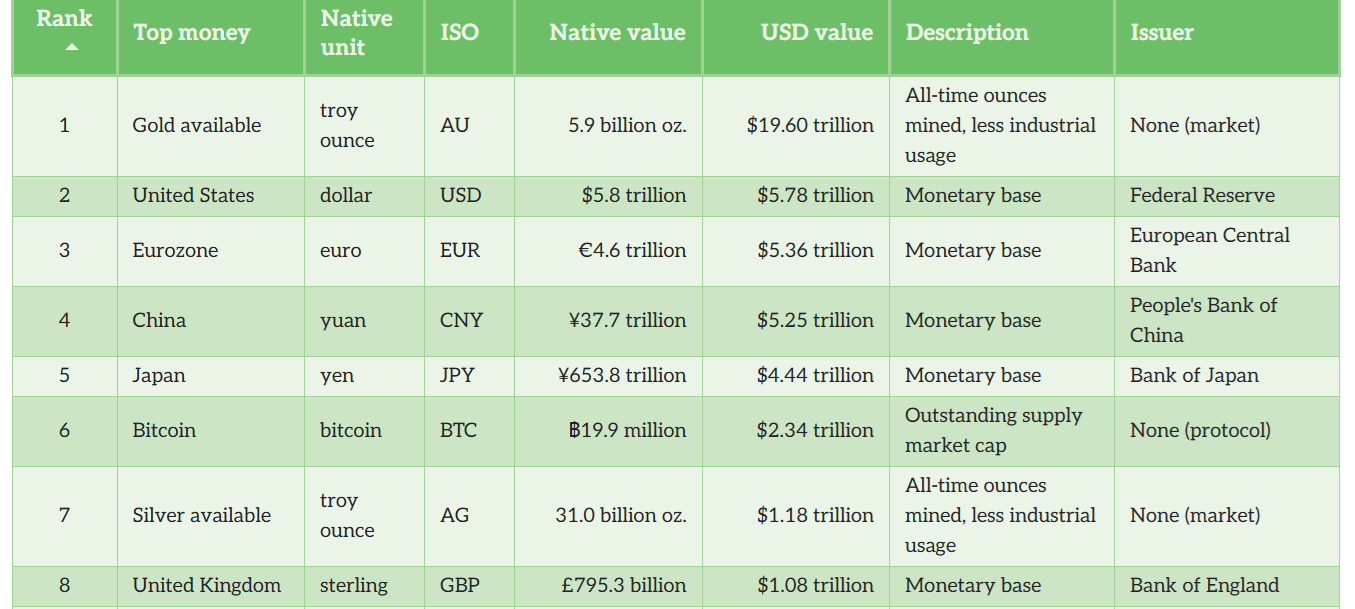

Currently, the US M0 monetary base is $5.8 trillion, followed by $5.4 trillion in the eurozone, $5.2 trillion in China, and $4.4 trillion in Japan, according to Porkopolis Economics. With China accounting for 19.5% of global domestic product, its monetary policy decisions remain crucial, even when the US Federal Reserve dominates headlines.

On Thursday, China reported a 0.1% decline in July retail sales compared with the prior month. Goldman Sachs estimates show that in July alone, investments in fixed assets fell 5.3% year-over-year, the steepest contraction since March 2020. Meanwhile, industrial production rose by just 0.4% during the month. China’s survey-based urban unemployment rate also climbed to 5.2% in July, up from 5% in June.

Bloomberg Economics analysts Chang Shu and Eric Zhu noted that the People’s Bank of China (PBOC) could introduce stimulus measures “as soon as September.” Similarly, economists at Nomura and Commerzbank argued that it is only a matter of time before stronger support policies arrive.

Still, even if the PBOC adopts a more expansionist stance, cryptocurrency investors may hesitate if global recession fears intensify.

US consumer sentiment deteriorates, but traders are not fearful

The University of Michigan’s consumer survey, released on Friday, showed that 60% of Americans expect unemployment to worsen over the next year, a sentiment last recorded during the 2008–09 financial crisis. Yet markets have remained resilient. The S&P 500 closed at a new all-time high, while yields on 5-year Treasurys also moved higher, suggesting investors still lean toward optimism.

Related: Bitcoin’s all-time high gains vanished hours later: Here’s why

When recession fears rise, demand typically increases for assets backed by the US government, allowing investors to accept lower yields. After dropping to 3.74% on Aug. 4, the lowest level in more than three months, 5-year Treasury yields rebounded to 3.83% on Friday. The move indicates traders are becoming less risk-averse, opening space for a rebound in altcoin market capitalization.

If China follows through with stronger stimulus, that added liquidity could be the catalyst for a broad rotation into risk assets. In such a scenario, the push from the PBOC may be enough to propel cryptocurrencies to fresh all-time highs.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.